Print Management Solutions

Thousands of businesses in the UK use Print Management Solutions to support their growth. How can we help you?

Thousands of businesses in the UK use Print Management Solutions to support their growth. How can we help you?

Technology Leasing are very experienced in leasing and finance of printing equipment for UK businesses. Print is often an overlooked factor in the cost of running a business and for many companies there is a heavy dependence on paperwork, where a physical copy of a document is just as important as a digital one. Printing equipment has seen incredible innovation over time and acquiring the latest equipment can be very expensive. This is where our financing solutions can really benefit a business, helping you align your true printing costs with a simple monthly payment plan.

1. For enquiries over £100,000, please contact us directly on 0116 243 8822.

2. The rental price indicated is for general guidance and is subject to credit approval.

3. Business users only.

Can we finance the Professional Services element of the IT Solution?

Yes, you can. We need to establish what percentage the Professional Services are of the total spend. Once we know that, there are several ways we can incorporate Professional Services into a lease.

How long can I finance the equipment over?

We can lease all the equipment over a 1 – 5 years period. Most deals are made over 1 – 3 years due to the lifetime of the equipment, however, this can be any number of months that you need it to be financed over. We do this so it gives you as the customer an easier and more flexible option to lease.

Can I decide to keep the equipment at the end of the lease?

Yes, you do have the option to purchase the equipment at the end of your agreement. However, you also have the option to keep the equipment and continue the monthly payments or give the equipment back to us. Again, just another way that we offer flexible finance solutions for you.

How quickly can you arrange an IT equipment lease for me?

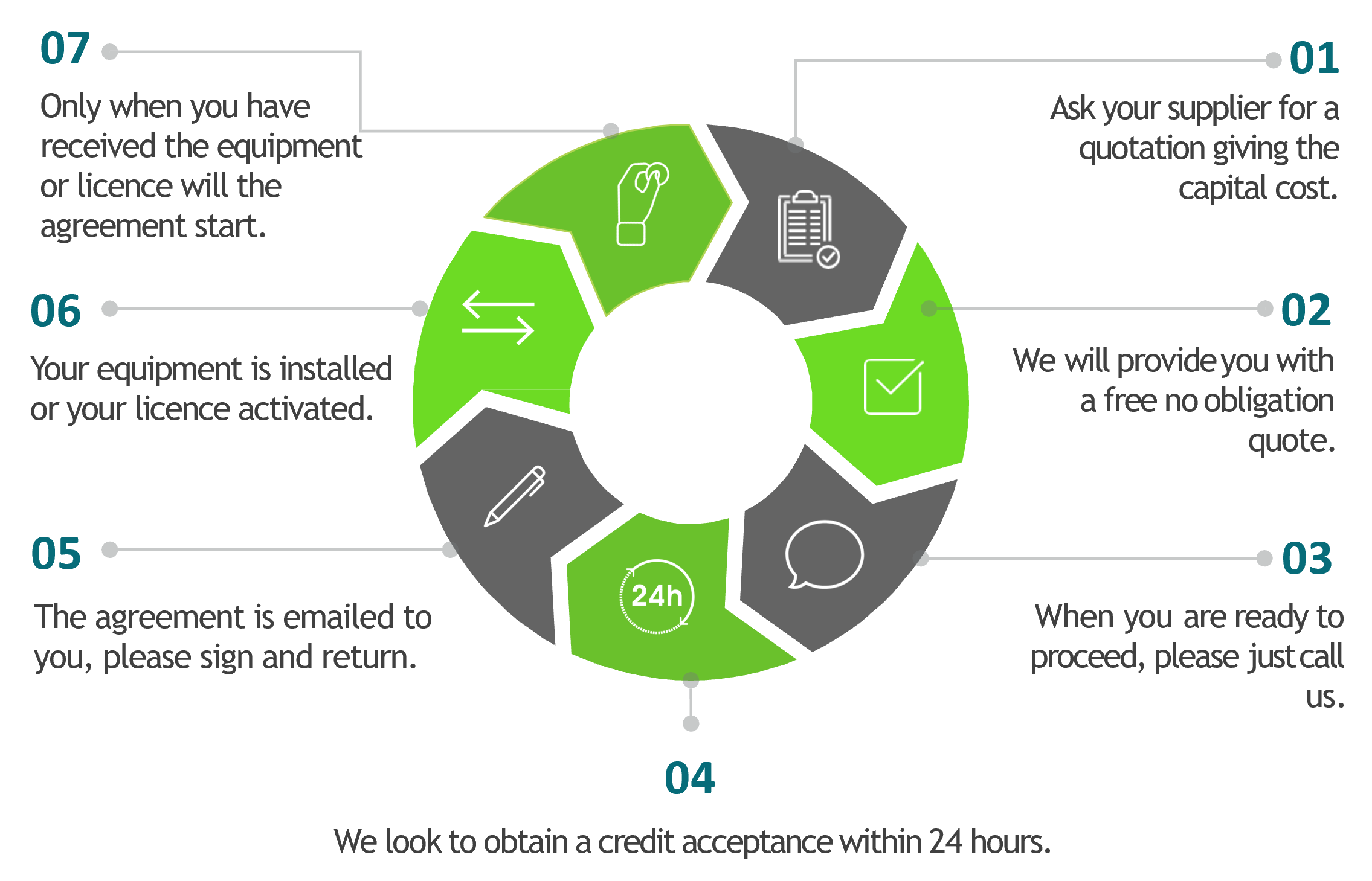

Applications can be accepted within a few hours and once documents are signed, the equipment can be delivered, and the agreement can be activated within 2 working days. We aim to be fast in the turnaround of your agreement, and we will always get back to you within the first 24-hour period.

Is there an advance payment?

Often, we take a one-month deposit. However, to keep the monthly rentals lower you can pay more upfront if you wish, it will normally depend on your agreement.

I am a new start company will you credit clear me?

If you are a homeowner and have a clear personal credit history, we should be able to source funds for you, normally up to £50,000 for equipment including software. We might ask you for certain documents, but provided you meet our standard requirements, we will be able to credit clear you.

I am an established business trading over 3 years, what information do you need from me?

Often, we just look at the information in the public domain over on Companies House. However, there are times when we will ask to see bank statements, last year’s full audited accounts and management accounts. Again, these should all be standard documents that will not slow the process down.

Can I use my own supplier?

Yes, you are able to choose a supplier of your choice, if they are a reliable supplier for both us and you to use.

Does Technology Leasing provide supplier/ manufacturer recommendations?

Yes, we work alongside several suppliers of equipment, including computers, laptops and software. We would be more than happy to put you in touch with a company who can assist, whilst alternatively offering you the option to provide your own supplier/manufacturer.

How cheap are your rates?

We do not normally lose business because we are too expensive. Our view is to give cheap lease rates and make sure we do more business together in the future. Building relationships with clients is something that we hold highly here at Technology Leasing.

I have been rejected by another finance company; will you be any different?

For some companies it’s seen as too big a risk to finance equipment such as software. This is because there is no tangible asset to be used as security should anything happen to your company during the lease term. Here at Technology Leasing we are specialists in the financing of IT equipment, including software. Therefore, if one company has said no, don’t assume Technology Leasing will do the same!

Can I settle the term agreement early?

Yes, if this is something you wish to do. The finance company will work out a settlement figure based on how many rentals are left to pay.

What happens if the equipment breaks, will it be insured?

Under the terms of the agreement your equipment will be insured, so new equipment can be sent out. However, you as the customer are responsible for maintaining and servicing the equipment such as a laptop.

Always have the latest IT technology at your disposal by implementing a recycling strategy, whereby you replace equipment at the end of the lease term

You will be able to keep funds in your business to be used elsewhere

You don’t have to use up a bank facility you already have

On rental agreements, the VAT is included in the rental, not in a lump sum

Companies pay employees over time as they work, so why pay all the cost for IT equipment in advance?

Using a lease rental agreement, 100% of your rental is deductible against your companies corporation tax